Home Services is a $500 Billion Dollar Industry

This year we conducted a deep dive into the home service market to develop our own estimate of the total market size, distinguish the home services market from home sales and new home construction, look at some of the fundamental drivers of market growth, and make some predictions about the future.

Using our data on consumer spending attributes, we built a model that predicts spending for every household in America in order to determine a new estimate of the total spending levels across the country on home services, generating a new top line estimate of the market that entered 2020 with spending levels of $506B per year.

Key Takeaways:

- Home services is a $506 billion-dollar market in the United States, roughly the same size as our total combined exports to Canada and the United Kingdom. Totalling an estimated $23.3B in home emergency spending, $61.9B in home maintenance spending, and $420.8B in home improvement and renovation spending.

- The market supports approximately 5 million direct individual jobs, across over two dozen broad categories of skilled tradespeople, creating a path to debt-free wealth and entrepreneurship for millions of Americans. This talent pool composes approximately 3% of the national workforce and is roughly equal to the entire population of South Carolina.

- Americans are completing approximately 511,345,000 home service jobs each year, about 16 jobs per second.

- The home service industry provides the rest of the national economy with a healthy boost from the strong economic multiplier effect of home services, which provides an average of 1.8 times additional economic output, while creating $320.1 billion in additional household income, and 732,844 additional jobs in adjacent or supporting industries like manufacturing, marketing, and transportation. This is around the same contribution to the U.S. economy as the entire state gross domestic product of Connecticut.

- As the more than 90 million Americans currently at or below typical home buying age start to age into a position to buy homes, both financially and socially, the home service industry is poised to continue growing at a rapid pace.

In addition to estimating the overall market size with a new methodology, the report also:

- Provides new estimates of the large, important top line numbers that describe the industry in addition to the new spending, service request, and skilled tradesperson estimates 24 households serviced per full time professional, 4% of a full time home service job supported per household, 4.1 tasks per household per year, and 102 requests per trade person per year.

- The report draws a distinction between the housing market and the home service market; noting that while home construction and home sales are large and important sectors of the economy, they’re separate activities than the ongoing service, maintenance, and improvement of our homes.

- It highlights the distinction between discretionary and non-discretionary spending, across the three broad categories of home service task types – improvement, maintenance, and repairs.

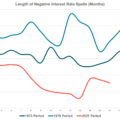

- It explores the cyclical and counter-cyclical nature of the market: what components trend with the business cycle, and what components trend against it providing an important counterweight in times of recession.

The full report contains those insights and many others, you can read the whole thing here: Home Service Market 2020 Full Report

Press & Media Inquiries

Press & Media Inquiries Angi Economics

Angi Economics